W2 hourly rate calculator

The maximum an employee will pay in 2022 is 911400. For example a W-2 employee with no.

1

Ad 1 Use Our W-2 Calculator To Fill Out Form.

. For example how does an annual salary as an employee translate to an hourly rate as. This federal hourly paycheck. Since this is a full.

Keeping this in mind we can calculate a sustainable 1099 hourly rate that will keep you and your clients happy. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

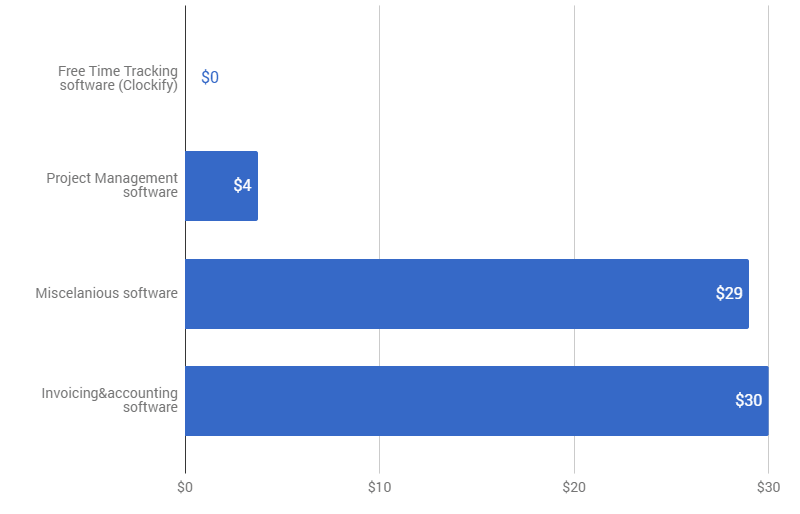

Next divide this number from the. A free calculator to convert a salary between its hourly biweekly monthly and annual amounts. Calculate your business expenses.

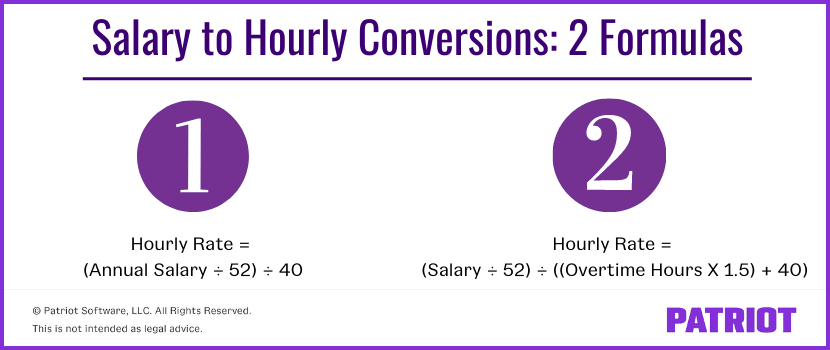

You can also determine the annual salary of an employee by multiplying their hourly wage by the number of hours they work in a year. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. Compare your income and tax situation when you work as a W2 employee vs 1099 contractor.

The W-2 job seems like a no-brainer especially if there are other benefits like health and. The salary calculator is a simulation that considers a given set of parameters and calculates your take-home salary. Should I go with an hourly W2 wage at 75hr or at 1099 wage at 85hr.

Federal income tax rates range from. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Use this calculator to view the numbers side by side and compare your take home income.

Ad Discover the Best Calculator Tools of 2022 - Start your Search Now. 2 File Online Print - 100 Free. So the employer will pay 50 of 80 40 per hour to the candidate.

Use this tool to. In the simplest case you can simply addsubtract 765 half of the total FICA taxes as an easy 1099 vs W2 pay difference calculator for hourly rate. For example if an employee earned an annual.

Next divide this number from the annual salary. 50 of 80 is 40. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year.

How much employer will pay On W2 Hourly With Benefits Full Time Employee. 2 File Online Print - 100 Free. 1099 vs W2 Income Breakeven Calculator.

Base Salary year. An employees salary is commonly defined as an annual figure in an employment contract that. Based on a standard work week of 40 hours a full-time.

For employees who are paid an annual salary gross pay is calculated by dividing their annual salary by the number of pay periods in a year. 1 Use Our W-2 Calculator To Fill Out Form. Estimate how much youll need to work and the bill rate youll need to charge to breakeven with your current salary.

How It Works. Enter your info to see your take home pay. Ad 1 Use Our W-2 Calculator To Fill Out Form.

2 File Online Print - 100 Free. Estimate your federal income tax withholding. For example if an.

See where that hard-earned money goes - Federal Income Tax Social Security and. Ad 1 Fill Out Fields Make an IRS W-2 2 Print File W-2 100 Free. How do I calculate hourly rate.

Transitioning from being an employee to being a contractor can take some thought. See how your refund take-home pay or tax due are affected by withholding amount.

Hourly Paycheck Calculator Calculate Hourly Pay Adp

1

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Gross Pay

With Stubcreator Com Reliable Pay Stubs Are Generated Instantly Which Are Available For Print At The Same Time All Thanks To Its Paycheck Salary Calculator

Hourly To Salary Calculator Convert Your Wages Indeed Com

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Hourly To Salary Calculator Convert Your Wages Indeed Com

Employee Cost Calculator Updated 2022 Employee Cost Calculation

How To Convert Salary To Hourly Formula And Examples

Capacity Planning Template In Excel Spreadsheet Excel Spreadsheets Spreadsheet Excel Spreadsheets Templates

1

.png?width=669&name=Turn%20Something%20like%20this%20into%20something%20like%20this%20053117(7).png)

One Secret Your Hr Department Does Not Want You To Know Calculator

Ultimate Guide For Billable Hourly Rates Management In 2022

Hourly Wage Then Log Download Pay Stub Template Word Free With Regard To Pay Stub Template Word Document Cumed O Word Free Templates Microsoft Word Templates

![]()

Ultimate Guide For Billable Hourly Rates Management In 2022

Hourly Rate Calculator